Chasing Choices: Your Path to Wealth

|

The Lone Star Perspective

Clarity around money, life, and health!

The Lone Star Perspective by Matt Magee at mForce Capital Treasury 101: Why the “Plumbing” of Global Finance is Changing We often talk about the U.S. Treasury market as the "bedrock" of the financial world. It is the gold standard for safety. But even a bedrock can shift. Recent data from Apollo Global Management highlights some massive changes in how the U.S. government borrows money and, more importantly, who is lending it to them. Here is a breakdown of what’s happening in "plain English"...

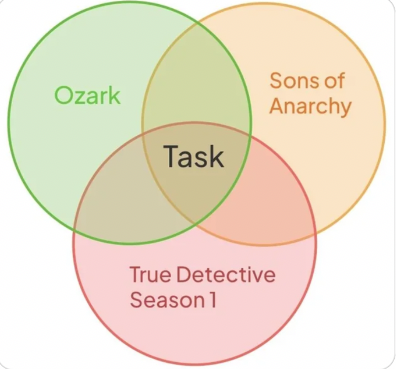

The Lone Star Perspective by Matt Magee at mForce Capital The Van-Dweller’s Edge Amity Warme is one of the most accomplished big-wall climbers in the world. She lives in a van. Tacked to the wall of that van is a scrap of paper with five words that carry more weight than any financial plan: “Do my choices support my goals?” It’s a deceptively simple question. It’s also the one most people, myself included, fail to answer honestly every single day. In the world of finance, we love to bury the...

The Lone Star Perspective by Matt Magee at mForce Capital Starting the year with a positive story. If you are anything like me, you see business headlines all day, and they never strike a chord. Similar to OpenAI raising another mega round from investors, or Vista Bank being sold for around $370 million. It's often like Wow, those numbers are huge and life-changing for a few people. But the story of Fibrebond provides a different blueprint. The founder shared 17% of the sale proceeds with the...